- PIN'd

- Posts

- PIN

PIN

A newsletter for communities, investors, angels, and founders

Welcome to PIN’d - our weekly newsletter where we pin (lol, bear with us) the most important tech/startup news of the week for aspiring angels, vc’s, startup investors, founders, etc. Expect a new weekly roundup from us every Friday morning!

If you’re receiving this, it’s because you’ve signed up for our waitlist and/or for newsletter updates.

Got a friend that wants to learn more or stay up to date on angel investing/VC? Help us spread the word and forward this email to them ;)

Subscribe here.

📰 This week’s best news

After a lot of drama last week, Cognition is the final winner acquiring Windsurf, the fast-growing agentic IDE with $82 million in ARR and 350+ enterprise clients. The deal brings Windsurf’s IP, brand, and entire team into Cognition, including top engineering and GTM talent. The integration will center on merging Windsurf’s IDE with Devin, Cognition’s AI software engineer.

Matt Miller, former Sequoia partner, is back with Evantic Capital, a $400 million fund aiming to back Europe’s next tech giants. More than 100 founders and operators joined as LPs, betting on Miller’s founder-first, late-stage strategy. With a London HQ and global flexibility, Evantic wants to fill the Series B and C funding gap in Europe.

Kris Fredrickson, former Coatue and Benchmark investor, just launched Verified Capital with $175 million to back breakout AI startups. His fund takes a focused approach, just 8 to 10 bets, no board seats, and total flexibility. Backers include founders from Coinbase, Instacart, and Harvey AI. Perplexity, Harvey, and Atlas are already in the portfolio.

Mira Murati, former OpenAI CTO, has raised $2 billion for her new AI venture, Thinking Machines. The company, launched just months ago and without a product yet, is already valued at $12 billion. Backers include Andreessen Horowitz, Nvidia, Cisco, and AMD. Nearly two-thirds of the team are ex-OpenAI, betting big on safer, more adaptable AI.

OpenAI launched an artificial intelligence agent for its popular chatbot ChatGPT on Thursday that can complete complex tasks as the Microsoft-backed startup looks to get ahead of competitors in the AI race.

Fyre Festival, the infamous luxury music fest, just sold on eBay for $245,300. Fraudster Billy McFarland offloaded the brand, though it’s unclear who bought it or why. McFarland pitched it as a global entertainment opportunity (despite the $26 million in restitution he still owes).

Fast-growing Swedish AI vibe coding startup Lovable has become Europe’s latest unicorn. Only eight months since its launch, the startup has raised a $200 million Series A round led by Accel at a $1.8 billion valuation.

A new VC fund backed by Peter Thiel is raising over $500 million to rethink how venture capital works. GPx plans to support emerging fund managers at the seed stage, then double down on their top bets at Series B. It’s a hybrid model built to help small VCs stay in the game as deals scale. The fund is led by former Founders Fund and Quiet Capital partners.

💰 Funding announcement highlights

Unify, a three-year-old San Francisco startup helping sales teams at AI companies automate personalized outreach via email and LinkedIn, raised a $40 million Series B. Battery Ventures led the round, with OpenAI Startup Fund, Thrive Capital, Emergence Capital, Abstract Ventures, The Cannon Project, and Capital49 also joining.

Vultron, a startup helping federal contractors and agencies automate business development and proposal writing using AI tools, raised a $17 million Series A round. Greycroft was the main investor, with Craft Ventures, Long Journey Ventures, and South Park Commons also contributing.

Cogent Security, a startup offering AI-powered software that automates the finding, prioritizing, and fixing of software vulnerabilities for security teams within large organizations, raised an $11 million seed round. Greylock Partners led the deal.

OpenEvidence, a three-year-old Miami startup helping doctors quickly find evidence-based answers from medical literature using AI, raised a $210 million round. GV and Kleiner Perkins co-led the deal, with Coatue, Conviction, and Thrive Capital also contributing.

Tavrn, a startup helping personal injury law firms automate repetitive legal tasks using AI agents that handle work like drafting documents and organizing case files, raised a $15 million Series A round. Left Lane Capital was the main investor, with A*, Hummingbird Ventures, and Box Group also showing up.

📚 Interesting reads of the week

Windsurf turned down OpenAI, watched Google pay $2.4B for just its founders, then sold everything else to Cognition. In a wild weekend twist, Cognition scooped up the full company, product, IP, customers, and 250 engineers, with full employee equity and accelerated vesting. Google got the talent, but Cognition got the empire.

Calvin French-Owen just pulled back the curtain on his year inside OpenAI. His blog details the chaos of hypergrowth, the race to launch Codex, and a company still acting like a startup despite tripling in size. While outsiders debate existential risks, insiders focus on real-world harms like bias and abuse.

Founders today have more power, more funding options, and less need for traditional VCs. As capital floods into megafunds and tiny microfunds, mid-sized firms are being squeezed out. The best founders now choose between global giants or hands-on specialists funds. In this new world, it's adapt, evolve, or disappear.

Startup funding in the US jumped 76% in H1 2025, driven by AI deals that made up 64% of total capital raised. Giants like OpenAI, Meta, and Grammarly led the charge with multibillion-dollar rounds. But while startups thrive, VC firms are facing a different reality, with fundraising down 34%. The split between hot AI demand and sluggish VC fundraising is widening fast.

At some of the Bay Area’s top restaurants, dinner starts before you arrive. Teams at places like Lazy Bear and SingleThread research guests online to create hyper-personalized experiences, from penguin adoptions to custom drinks from your hometown. In fine dining, the new secret ingredient is data.

Despite the rise of remote work, the Bay Area still reigns as the epicenter of B2B, SaaS, and now AI. Founders benefit from deep talent pools, aggressive VCs, and proximity to key partners like Salesforce and OpenAI. It’s intense, expensive, and competitive, but if you're aiming to scale big, few places offer more leverage.

AI is creating massive value from scarce resources like GPUs and top-tier talent, and reshaping tech power dynamics. Apple’s slow bet on AI reflects a cautious, tool-based philosophy, while Meta is going all in on agentic AI that does things for users. Microsoft and OpenAI land somewhere in between, each navigating strategy, scale, and culture.

💪Tech mafia of the week

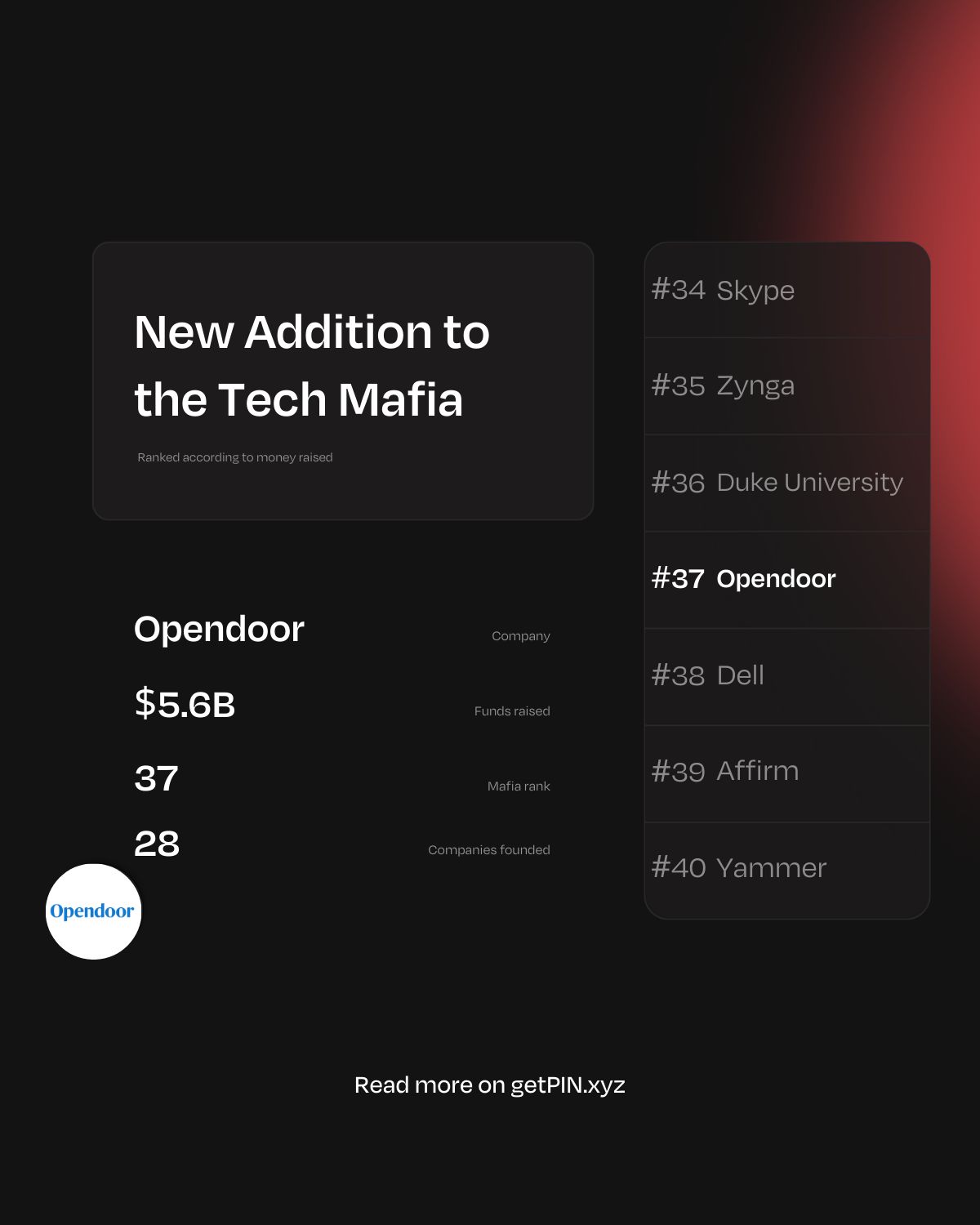

Highlights:

💰 Most money raised: Affirm

🤑 Total money raised by the Opendoor Mafia: $5.6 billion

Weekly Tech Mafia Leaderboard

The Opendoor alumni has built some amazing companies. This tech mafia group takes the 37th spot on our leaderboard, with 28 companies founded and $5.6 billion raised.

PS: Are you an Opendoor alum interested in getting your community together to invest in the community (and earn carry/other benefits along the way)? Or are you a member of another community that you think would make for an amazing startup investment community?

Learn more about us and sign up for the waitlist here.

📌 PIN tweet of the week

Who really holds the power in venture capital?

It's not just about check size. It's about influence, reach, and conviction.

These are the 10 VC firms with the deepest pockets in 2025 👇

1️⃣ Tiger Global– $58.5B

Bounced back fast after a brutal 2022. Closed 2023 with +28.5%

— PIN (@getpinxyz)

12:11 PM • Jul 17, 2025

💼 Who’s hiring in VC?

Looking to get into VC? Below are this week’s curated VC job openings.

Quona is looking for a VC Manager.

Biogen is looking for a Senior VC Director.

Inventure is looking for a Senior VC Associate.

3M Ventures is looking for a VC Director.

American Century Investments is looking for a VC Analyst.

📌 Introducing PinPoint - Get paid to refer your friends to great jobs

Want to earn thousands of dollars for referring candidates to top companies? Sign up to PinPoint.

📠 Fun fact of the week

Although only a tiny fraction of startups receive VC funding (around 600–800 out of nearly 2 million new US businesses per year), venture-backed firms generate about 11% of all private sector jobs and account for 21% of US GDP.