- PIN'd

- Posts

- PIN

PIN

A newsletter for communities, investors, angels, and founders

Welcome to PIN’d - our weekly newsletter where we pin (lol, bear with us) the most important tech/startup news of the week for aspiring angels, vc’s, startup investors, founders, etc. Expect a new weekly roundup from us every Friday morning!

If you’re receiving this, it’s because you’ve signed up for our waitlist and/or for newsletter updates.

Got a friend that wants to learn more or stay up to date on angel investing/VC? Help us spread the word and forward this email to them ;)

Subscribe here.

📰 This week’s best news

Joshua Kushner’s Thrive Capital and investment firm Capital Group have in recent months visited China to learn about its AI industry, joining a growing number of US investors rekindling interest in the country after DeepSeek’s advances stunned Silicon Valley.

The rivalry between Deel and Rippling just got messier. Deel now claims a Rippling employee posed as a customer for six months to spy on its platform and copy its products. Deel’s amended complaint also alleges that “Rippling has planted false and misleading claims about Deel in the press and with regulators across the country.”

Nucleus Genomics has been making the rounds on socials with its new launch which people have mixed feelings about. With U.S. birthrates plummeting and IVF on the rise, Nucleus Genomics launched Nucleus Embryo, the first genetic optimization software that lets parents see and understand a complete genetic profile to select an embryo.

After early bets on hits like Perplexity and Harvey, Elad Gil is now backing a new kind of AI play, by buying traditional businesses and using AI to scale them fast. He believes roll-ups powered by automation can unlock huge margins and reshape entire industries like law and healthcare.

Yoshua Bengio is launching LawZero, a nonprofit backed by $30 million, to develop safer AI systems that act more like scientists than decision-makers. The goal is to create oversight tools that help keep powerful AI agents in check before things get out of control.

Deel has hit a $1 billion annual revenue run rate six years after launch, with 75 percent year-over-year growth and a presence in over 150 countries. The company, now profitable for nearly three years, credits its global customers and team for making this milestone possible.

The five-day firing and rehiring saga of Sam Altman at OpenAI is heading to the big screen. Amazon MGM Studios is developing Artificial, with director Luca Guadagnino and a cast that may include Andrew Garfield, turning Silicon Valley’s wildest boardroom drama into entertainment.

💰 Funding announcement highlights

Mubi, an 18-year-old global streaming service for independent and classic films, raised a $100 million round. Sequoia Capital led the deal.

Netic, a startup using AI to help home-services companies like plumbers and HVAC firms book appointments, follow up with customers, and manage schedules, raised a $20 million round. Greylock, Founders Fund, and Day One Ventures were part of the investors.

Console, a San Francisco startup helping IT teams automate routine tasks like password resets and app access requests via an AI assistant in Slack, raised a $6.2 million seed round. Thrive Capital was the main lead.

Archil, a one-year-old startup providing instant, shareable volume storage to help data teams turn cloud buckets into high-performance local file systems, raised a $6.7 million seed round. Felicis was the main investor, with Y Combinator, Peak XV, Wayfinder, General Catalyst, Lombardstreet Ventures, and Twenty Two Ventures also joining.

Clara Home Care, a San Francisco-based technology platform enabling families to directly hire and manage in-home senior caregivers, raised a $3.1 million seed round. Torch Capital, Virtue, and Y Combinator were the co-leads.

📚 Interesting reads of the week

Can writing that sounds good also make the ideas better? Paul Graham thinks so in his latest essay. In this essay, he argues that rhythm and clarity are not just aesthetic touches. They help sharpen thinking and make it easier to spot and fix weak ideas.

AI is making it easier and faster to launch startups, but not all of them are attracting investors. Experts warn this could lead to a rise in "zombie" VC funds, firms that are stuck with no capital left to invest and no clear future.

AI is evolving faster than any past tech shift, and the numbers prove it. Bond’s latest report tracks the explosive growth in users, usage, and funding, showing how AI adoption is outpacing even the internet’s early days. The race is moving quickly across startups, tech giants, and entire countries.

Amanda Robson launched Modern Technical Fund as a solo GP and closed $22 million in one of the toughest VC climates. Her no-sleep, hands-on style and focus on technical founders are helping her punch far above her weight in early-stage investing.

Where you choose to live shapes your relationships, career, and access to opportunity more than most people realize. Big cities amplify your network, accelerate exposure to ideas, and increase your chances of meeting the right people. Your geography is not just where you are. It influences who you become.

What happens when we stop performing and start preserving what is ours alone? In this essay, the author makes a fierce case for privacy, mystery, and joy that needs no audience. A quiet rebellion in a world addicted to being seen.

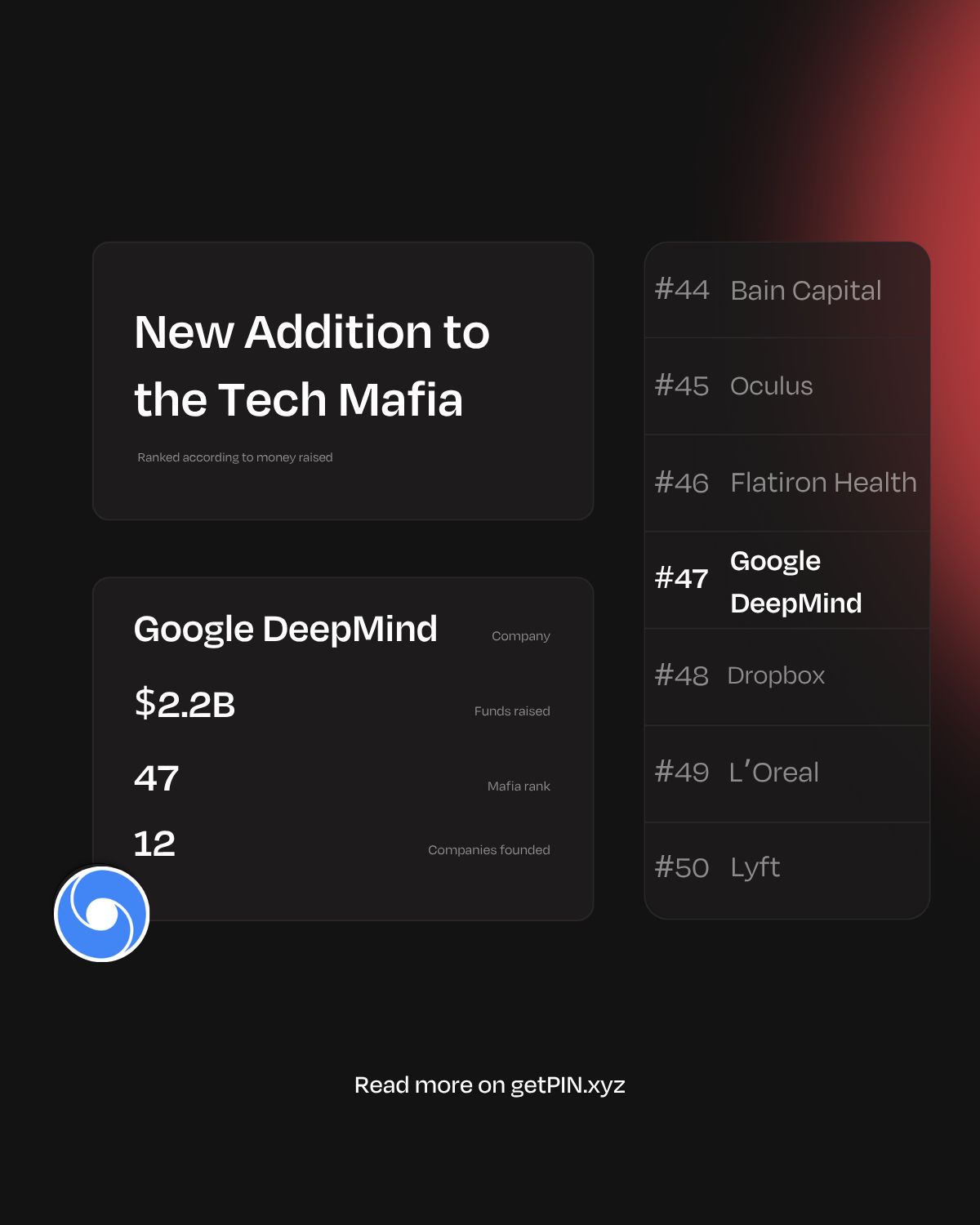

💪Tech mafia of the week

Highlights:

💰 Most money raised: Mistral AI

🤑 Total money raised by the Google DeepMind Mafia: $2.2 billion

Weekly Tech Mafia Leaderboard

The Google DeepMind alumni has built some amazing companies. This tech mafia group takes the 47th spot on our leaderboard, with 12 companies founded and $2.2 billion raised.

PS: Are you a Google DeepMind alum interested in getting your community together to invest in the community (and earn carry/other benefits along the way)? Or are you a member of another community that you think would make for an amazing startup investment community?

Learn more about us and sign up for the waitlist here.

📌 PIN tweet of the week

Why build the next big thing when you can buy it?

Since 2000, Alphabet alone has acquired 222 startups. Let that sink in.

And it’s not the only one.

This isn’t just about growth. It’s about survival.

Here’s the full list of Fortune Global 500 companies with the most startup

— PIN (@getpinxyz)

12:28 PM • Jun 2, 2025

💼 Who’s hiring in VC?

Looking to get into VC? Below are this week’s curated VC job openings.

Unreasonable is looking for a VC Manager

Theory Ventures is looking for a VC Investor

IgniteXL is looking for a VC Analyst

MM Catalyst Funds is looking for a VC Principal

Applied Ventures is looking for a Senior VC Director

📌 Have you signed up? :)

PIN is launching an investor database. Currently in beta mode, but we’d love to give our community of subscribers early access to try it out. PIN’s investor database is the best way to find angel investors & VCs who are actively investing, relevant to your stage/industry, and recommended by top VC-backed founders.

📠 Fun fact of the week

Since 1974, 42% of companies that have gone public in the U.S. had venture backing, showing VC’s outsized influence on the business landscape.

Want to learn more about investing in startups with your community through PIN’s platform? Simply reply to this email.