- PIN'd

- Posts

- PIN

PIN

A newsletter for communities, investors, angels, and founders

Welcome to PIN’d - our weekly newsletter where we pin (lol, bear with us) the most important tech/startup news of the week for aspiring angels, vc’s, startup investors, founders, etc. Expect a new weekly roundup from us every Friday morning!

If you’re receiving this, it’s because you’ve signed up for our waitlist and/or for newsletter updates.

Got a friend that wants to learn more or stay up to date on angel investing/VC? Help us spread the word and forward this email to them ;)

Subscribe here.

📰 This week’s best news

Telegram has reached over $1 billion in revenue this year, driven by advertising and paid subscriptions, marking a major financial milestone. Cryptocurrency has been key in sustaining Telegram, with the selling of hundreds of millions of dollars in digital assets this year, including Toncoin. Despite its growth, the company faces legal challenges, including the arrest of founder Pavel Durov in France and scrutiny over hosting illegal activities.

The venture capital world is seeing some big changes as top investors are leaving major firms due to bleak market conditions. Many are starting smaller, more focused funds aimed at helping early-stage startups. However, raising money is harder now, and new funds face challenges getting support from big investors.

Palantir and Anduril are reportedly forming a tech consortium to compete for U.S. defense contracts, potentially challenging established players like Lockheed Martin and Boeing. The group, which will be collaborating with companies such as SpaceX and OpenAI, aims to deliver cutting-edge technologies to the Pentagon more efficiently.

Elon Musk’s AI venture, xAI, has raised $6 billion in its latest funding round, backed by top investors like NVIDIA, AMD, and sovereign funds from Saudi Arabia and Qatar. With a valuation of $50 billion, the startup is challenging AI market leaders like OpenAI, focusing on developing products for billions while advancing AI research. Critics, however, question the profitability paths of such high-stakes investments.

Despite robust cash reserves and soaring stock prices, the "Big Five" tech companies—Apple, Microsoft, Nvidia, Amazon, and Alphabet—maintained a cautious pace in venture investments in 2024. Together, they participated in 149 startup financings of $1 million or more, a slight increase from 2023 but the second-lowest count in five years.

💰 Funding announcement highlights

Bluenote, a startup automating the creation of regulatory documents for pharmaceutical companies, enhancing efficiency and accuracy in their workflows, raised $10 million. Lux Capital led the deal, with Elad Gil, Anthropic & Menlo Ventures Anthology Fund, McKesson Ventures, Electric Capital, Moxxie Ventures, and Carbon Silicon Ventures also contributing.

PearAI, an AI-powered code editor designed to assist developers by providing features such as code completion, error detection, and debugging support, raised a $1.25 million seed round. Y Combinator, Goodwater Capital, Multimodal Ventures, Orange Fund, and Exitfund were part of the investors.

Backflip, a startup that allows designers to generate 3D designs using generative AI, raised a $30 million round. The deal was co-led by Andreessen Horowitz and New Enterprise Associates.

Boon, a startup that develops AI-driven tools to automate fleet management operations, raised a $20.5 million Series A. Previous investors Marathon and Redpoint Ventures led the deal.

Decart, a two-year-old startup enabling faster and more reliable training of large generative models, raised a $32 million Series A. The round was led by Benchmark, with previous investors Sequoia Capital and Zeev Ventures also showing up.

📚 Interesting reads of the week

Tomasz Tunguz forecasts a transformative 2025, with a resurgence in IPO activity led by Stripe and Databricks, alongside record AI-driven M&A deals. He also anticipates a 25% growth in the U.S. web3 workforce, consolidation in the data stack industry, and the emergence of a $100M ARR company with under 30 employees, driven by AI-native innovations.

After a big increase in initial public offerings in 2024, there’s a lot of hope for an even better year in 2025. In 2024, 266 companies went public, up from 214 in 2023, thanks to a strong stock market and excited investors. Big-name IPOs like Reddit, Ibotta, and Rubrik have paved the way for more companies to go public next year.

So far this year, there have been notable instances of investors returning to old firms, striking out on their own, or taking a pause from investing entirely. These changes are surprising, since venture capitalists don’t traditionally move around very much — especially those who reach the partner or general partner level.

Anti-dilution provisions are a key feature of venture capital agreements, designed to protect investors while supporting growth and innovation. Founders who understand these clauses can negotiate more effectively and safeguard their equity. For investors, these provisions offer essential protection, fostering confidence in pursuing high-risk, high-reward opportunities.

The venture capital industry is witnessing quite a divergence. Traditional firms like Benchmark Capital are sticking to small, focused investments, while giants like Andreessen Horowitz are pursuing massive growth with expansive portfolios. These contrasting approaches highlight a fundamental debate about the future of venture capital: Is success about staying small and agile, or scaling up to build empires?

According to Pitchbook, venture capital funding continues to be concentrated, with the top 30 VC firms accounting for 75% of all capital raised this year. These powerhouse firms dominate the market, leveraging their resources to control a significant portion of available funding.

In case you missed the latest trend, the Technology Brothers podcast officially launched and people are going crazy over it.

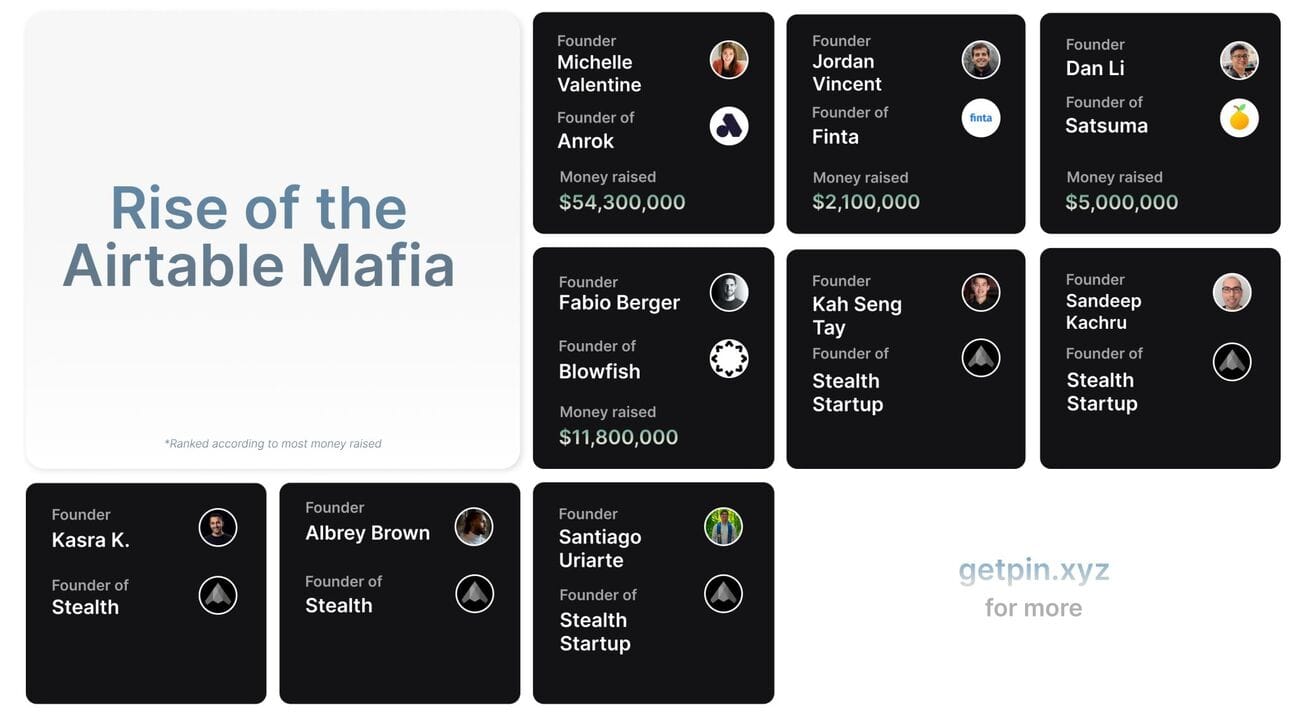

💪Tech mafia of the week

Highlights:

💰 Most money raised: Anrok

🤑 Total money raised by the Airtable Mafia: $75 million

Weekly Tech Mafia Leaderboard

The Airtable alumni has built some amazing companies. This tech mafia group takes the 76th spot on leaderboard, with 10 companies founded and $75 million raised.

PS: Are you an Airtable alum interested in getting your community together to invest in the community (and earn carry/other benefits along the way)? Or are you a member of another community that you think would make for an amazing startup investment community?

Learn more about us and sign up for the waitlist here.

📌 PIN tweet of the week

What do Airbnb, Reddit, and Stripe have in common?

@paulg's Y Combinator.

"𝘎𝘰𝘰𝘥 𝘸𝘰𝘳𝘬 𝘪𝘴 𝘤𝘰𝘮𝘮𝘰𝘯. 𝘎𝘳𝘦𝘢𝘵 𝘸𝘰𝘳𝘬 𝘪𝘴 𝘳𝘢𝘳𝘦. 𝘛𝘩𝘦 𝘥𝘪𝘧𝘧𝘦𝘳𝘦𝘯𝘤𝘦? 𝘊𝘶𝘳𝘪𝘰𝘴𝘪𝘵𝘺, 𝘣𝘰𝘭𝘥𝘯𝘦𝘴𝘴, 𝘢𝘯𝘥 𝘤𝘰𝘯𝘴𝘪𝘴𝘵𝘦𝘯𝘤𝘺."

Here’s Paul Graham's advice… x.com/i/web/status/1…

— PIN (@getpinxyz)

1:31 PM • Dec 23, 2024

💼 Who’s hiring in VC?

Looking to get into VC? Below are this week’s curated VC job openings.

Cintrifuse Capital is looking for a Senior VC Associate.

Avenir Group is looking for a VC Principal.

Waverley Street Foundation is looking for a Director of Impact Investing.

Eckuity Capital is looking for a VC Principal.

Sands Capital is looking for an Equity Research Associate.

📠 Fun fact of the week

About 11,000 new startups are launched every hour, or about three new startups every second.

Want to learn more about investing in startups with your community through PIN’s platform? Simply reply to this email.