- PIN'd

- Posts

- PIN

PIN

A newsletter for communities, investors, angels, and founders

Welcome to PIN’d - our weekly newsletter where we pin (lol, bear with us) the most important tech/startup news of the week for aspiring angels, vc’s, startup investors, founders, etc. Expect a new weekly roundup from us every Friday morning!

If you’re receiving this, it’s because you’ve signed up for our waitlist and/or for newsletter updates.

Got a friend that wants to learn more or stay up to date on angel investing/VC? Help us spread the word and forward this email to them ;)

Subscribe here.

📰 This week’s best news

TIME and Statista just unveiled the 350 VC firms shaping the future of the U.S. economy. Accel tops the list, followed by General Catalyst and Andreessen Horowitz, all known for backing iconic tech giants. These firms are recognized for backing early-stage startups, scaling bold ideas, and pushing innovation worldwide.

Chamath Palihapitiya is launching his 11th SPAC, aiming to raise $250 million to invest in energy, AI, DeFi, and defense. The deal links his compensation to performance, signaling a more disciplined approach. In a post-SPAC-mania environment, it marks a calculated return as Silicon Valley turns its focus to national infrastructure.

Databricks is raising $1 billion at a $100 billion valuation to compete in the AI database space. The funds will back two major plays: Lakebase, its new data engine, and Agent Bricks, a platform for AI-powered business agents. CEO Ali Ghodsi says the goal isn’t superintelligence, but software that can tackle real-world tasks.

Opendoor CEO Carrie Wheeler has resigned following investor pressure and weak earnings. The company’s stock has climbed since June, fueled by activist demands for new leadership. CTO Shrisha Radhakrishna will step in as interim CEO during the search for a permanent replacement.

A Florida judge has dismissed a sanctions-related lawsuit against Deel, which the company linked to rival Rippling. While Rippling denies involvement, Deel is framing the ruling as a blow to broader RICO claims it faces in California. The two HR tech firms are locked in a messy legal battle involving allegations of espionage and impersonation. This win gives Deel a small boost, but the main fight is far from over.

SoftBank is investing $2 billion in Intel, making it the chipmaker’s sixth-largest shareholder. The deal comes as Intel struggles with losses and ramps up efforts in AI. SoftBank won’t take a board seat or purchase Intel chips, but it deepens its semiconductor push. Intel shares rose 7% following the announcement.

Eight Sleep has raised $100 million to expand its smart sleep tech, including AI-powered mattresses that improve rest without wearables. With over $500 million in sales and users in more than 30 countries, the company is now eyeing FDA approval. It’s a big bet on sleep as the next frontier in health.

💰 Funding announcement highlights

TensorZero, a startup building open-source software to help companies develop, monitor, and improve large language model applications in production, raised a $7.3 million seed round. FirstMark was the main investor, with Bessemer Venture Partners, Bedrock Capital, DRW, and Coalition also showing up.

Pylon, a New York startup using AI to automate B2B customer service, raised a $31 million Series A. Andreessen Horowitz and Bain Capital co-led the deal.

Firecrawl, a San Francisco-based startup offering an open source and API-based web crawler used by developers, AI agents, and enterprises like Shopify and hedge funds to collect and search web data, raised a $15.5 million Series A round. Nexus Venture Partners led the deal, with Shopify CEO Tobias Lütke and previous investor Y Combinator also contributing.

Sola, a New York City-based AI co-pilot for Robotic Process Automation, raised a $17.5 million Series A funding. The round was led by Andreessen Horowitz with Conviction and Y Combinator also joining.

Medallion, a startup automating credentialing, enrollment, and compliance workflows for healthcare organizations, raised a $43 million round. Acrew Capital led the investment, with Washington Harbour Partners, Sequoia Capital, GV, Spark Capital, and NFDG also joining.

📚 Interesting reads of the week

Security expert and tech commentator Daniel Miessler says he’s more concerned than ever about a major economic unraveling. In this personal post, he warns that layoffs, surging debt, and the rise of AI are eroding the foundation of the knowledge economy. Tech unemployment, soaring delinquencies, and the cost of living could soon collide into a full-blown panic. The timeline? Anywhere from 2 to 18 months.

In this episode of Sourcery, Sophia Amoruso shares her journey from building cult brand Nasty Gal to launching her own VC firm backed by Silicon Valley elites. She also opens up about brand power, venture pitfalls, and why she’s betting on early-stage consumer and B2B startups.

VC fundraising remains sluggish in 2025, but emerging managers are starting to break through. Lean teams, early-stage bets, and deep ties to AI are helping them secure a bigger share of scarce capital. Solo GPs and micro-funds are gaining momentum, even as liquidity stays tight. Signs of recovery are there, but only for those with a clear edge.

Some of today’s most talked-about startups are being built by former Palantir employees. Tapping into a tight-knit network of ex-colleagues known as the “Palantir mafia,” these founders are finding support in hiring, funding, and strategic advice.The influence runs deep, with VC firms forming specifically to back Palantir alumni.

Bessemer’s latest AI outlook maps a fast-evolving landscape, three years after the ChatGPT breakthrough. Startups are coalescing into two groups: Supernovas, showing explosive growth, and Shooting Stars, grounded in strong fundamentals. Memory and context are becoming key competitive moats, while agentic apps and vertical AI are reshaping enterprise workflows. For founders, speed still counts, but having the right trajectory matters more.

The Generalist just dropped its 2025 Future 50 list, spotlighting the world’s most promising startups under $200 million in valuation. Curated with input from top investors and private traction data, the list covers AI, defense, fintech, and more. It’s a global look at lean, fast-moving teams with breakout potential. Full access is reserved for subscribers.

💪Tech mafia of the week

Highlights:

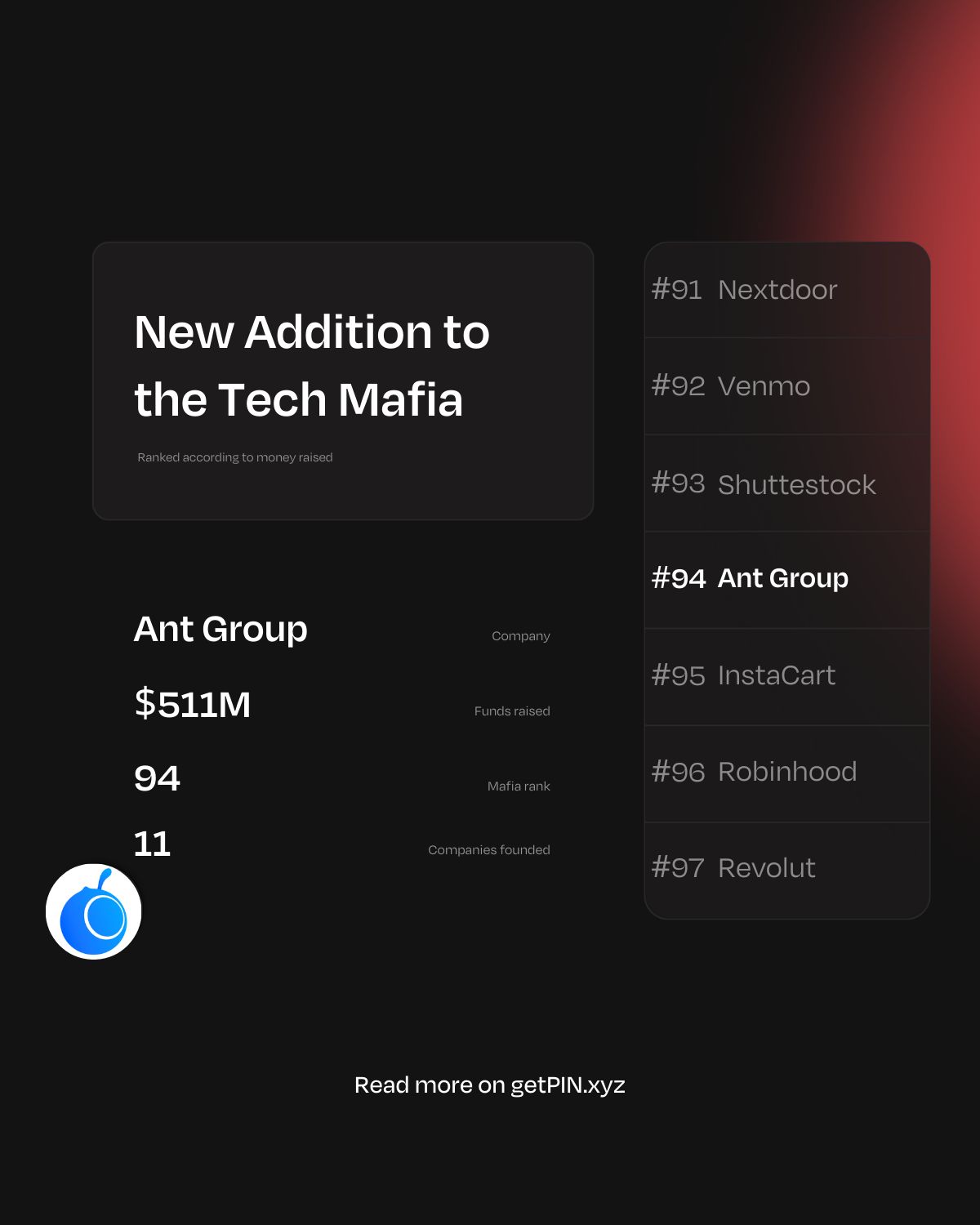

💰 Most money raised: XTransferGlobal

🤑 Total money raised by the Ant Group Mafia: $511 million

Weekly Tech Mafia Leaderboard

The Ant Group alumni has built some amazing companies. This tech mafia group takes the 94th spot on our leaderboard, with 11 companies founded and $511 million raised.

PS: Are you a Ant Group alum interested in getting your community together to invest in the community (and earn carry/other benefits along the way)? Or are you a member of another community that you think would make for an amazing startup investment community?

Learn more about us and sign up for the waitlist here.

📌 PIN tweet of the week

Who’s next in line to become a unicorn?

Forbes just dropped its Next Billion-Dollar Startups 2025 list, and it’s packed with names backed by Sequoia, a16z, Benchmark, Accel, and more.

Here's the breakdown and who to keep an eye on:

1. Acuity MD

Founders: @r__coe_— PIN (@getpinxyz)

3:40 PM • Aug 18, 2025

💼 Who’s hiring in VC?

Looking to get into VC? Below are this week’s curated VC job openings.

645 Ventures is looking for an Investment Partner

Four Cities Capital is looking for a VC Associate

Polychain Capital is looking for a VC Analyst

Accion is looking for a VC Associate

Canaan is looking for a VC Analyst

📌 Introducing PinPoint - Get paid to refer your friends to great jobs

Want to earn thousands of dollars for referring candidates to top companies? Sign up to PinPoint.

📠 Fun fact of the week

Mark Zuckerberg is red-green colorblind, which is why Facebook uses mostly blue.