- PIN'd

- Posts

- PIN

PIN

A newsletter for communities, investors, angels, and founders

Welcome to PIN’d - our weekly newsletter where we pin (lol, bear with us) the most important tech/startup news of the week for aspiring angels, vc’s, startup investors, founders, etc. Expect a new weekly roundup from us every Friday morning!

If you’re receiving this, it’s because you’ve signed up for our waitlist and/or for newsletter updates.

Got a friend that wants to learn more or stay up to date on angel investing/VC? Help us spread the word and forward this email to them ;)

Subscribe here.

📰 This week’s best news

The valuation of OpenAI has surged to $500 billion after employees and early investors sold $6.6 billion worth of stock to a group of global backers. The transaction makes OpenAI the most valuable private company in the world, surpassing Elon Musk’s SpaceX, which is valued at $456 billion.

AI funding has taken over the venture market at a speed never seen before. According to PitchBook, AI now accounts for more than 63% of VC dollars invested, far outpacing past peaks in fintech, crypto, or mobility tech. Valuations are soaring so high that only massive exits like CoreWeave’s $23 billion IPO could justify them. With mega-funds chasing deals earlier, even seed-stage startups are getting crowded out.

Charlie Javice, founder of financial aid startup Frank, was sentenced to seven years in prison for lying about the company's customer base before its $175 million sale to JPMorgan Chase in 2021. She falsely claimed the startup had 4M users (it had 300k) asked employees to create fake user data before the acquisition. She and co-defendant Olivier Amar will pay $278.5 million in restitution to the bank.

Periodic Labs has attracted over 20 researchers from OpenAI, Google DeepMind, and Meta, with many giving up tens of millions of dollars to join. The startup, co-founded by a ChatGPT co-creator, raised over $300 million in seed funding from a16z and others to build AI that accelerates scientific discoveries in physics and chemistry. Its plan: combine physical robots and AI trained on scientific literature to automate experiments at scale.

Thinking Machines Lab, a heavily funded startup cofounded by prominent researchers from OpenAI, has revealed its first product, a tool called Tinker that automates the creation of custom frontier AI models.

Biotech companies received just 8% of US startup investment so far in 2025, the lowest share in over 20 years. Investors have put $16.6 billion into biotech seed through growth-stage rounds, down sharply from previous years when the sector reliably pulled in over 15% of venture funding. The decline reflects both weaker investor enthusiasm due to Trump administration policies and voracious appetite for AI companies, which secured nearly $90 billion in North American deals in the first half of the year.

Boost VC raised $87 million for its fourth fund, backed mostly by family offices and high-net worth individuals. The firm, founded by fourth-generation Draper family member Adam Draper, writes pre-seed checks to deep tech startups across sectors from space to bioscience. Its first two funds from 2013 and 2016 have returned 2.15x and 4.35x to investors, with portfolio companies including Coinbase and $10 billion Colossal Biosciences.

Vercel raised $300 million at a $9.3 billion valuation, with Accel and GIC co-leading the round. The company has doubled its user base over the past year and seen 82% top line growth as it becomes the go-to platform for building AI applications. Its AI development agent v0 now has over 3.5 million users, with Teams and Enterprise accounts making up more than half of v0 revenue.

💰 Funding announcement highlights

Factory, a San Francisco-based company building AI technology for software development, raised a $50 million Series B round. NEA and Sequoia Capital led the deal, with Nvidia and J.P. Morgan also investing.

Flox, a New York City-based platform designed to simplify software development life cycles, raised a $25 million Series B round. Addition was the main investor with NEA, the D. E. Shaw group, Hetz Ventures, and Illuminate Financial also joining.

Zania, a San Francisco startup that uses AI agents to automate security, risk, and compliance work, raised an $18 million Series A round. NEA led the deal, with Anthology Fund and Palm Drive Capital also contributing.

Axiom Math, a San Francisco-based superintelligence platform, raised a $64 million seed round. B Capital led the deal, with Greycroft, Madrona, and Menlo Ventures also participating.

MAI, a San Francisco-based platform that automates and optimizes performance marketing, raised a $25 million seed round. Kleiner Perkins led the deal, with Gaorong Ventures, UpHonest Capital, and others also joining.

📚 Interesting reads of the week

A new Trump proposal would impose a $100,000 fee on each new H-1B visa petition, shaking the tech and startup world. Critics warn it could cripple immigrant founders before they even launch, calling it a “founder tax.” Others see a chance to modernize outdated immigration rules, pointing to alternative visas better suited for innovation. The debate highlights how deeply the future of U.S. startups is tied to global talent.

On Thursday, Andreessen Horowitz released its first AI Spending Report in partnership with the fintech firm Mercury. Using transaction data from Mercury, the report analyzes the top 50 AI-native application layer companies that startups are spending money on, similar to the previously published Top 100 Gen AI Consumer Apps.

Your calendar reveals your true beliefs about how the world works, and most founders are shocked by what it shows. Rob Snyder argues that successful startups require a deliberate operating philosophy built on understanding demand, not mimicking other companies or chasing VC approval. He breaks down the startup journey from idea to hypergrowth using his "case study factory" model, where your job is simply to repeat one successful customer story over and over.

Cluely founder Roy Lee gained 150k followers on X in six months and shares his hard-earned lessons about going viral. His key insight: on tech X/Twitter, deserving content will go viral once it hits a few thousand views, but virality alone won't save a mediocre product. Lee admits some of their most viral posts (49M views) generated almost zero downloads, arguing that sustainable growth must always be product-led.

Claire Butler, Figma’s first marketer, says startups should stop waiting for the “perfect” moment to launch. Picking a date forces tough decisions about features, positioning, and messaging. She argues that the prep work often matters more than the launch day itself. The goal is momentum, not perfection.

Podcaster Lex Fridman sits down with Telegram founder Pavel Durov for an in-depth conversation covering his recent arrest and his perspective on content moderation.

💪Tech mafia of the week

Highlights:

💰 Most money raised: Armada

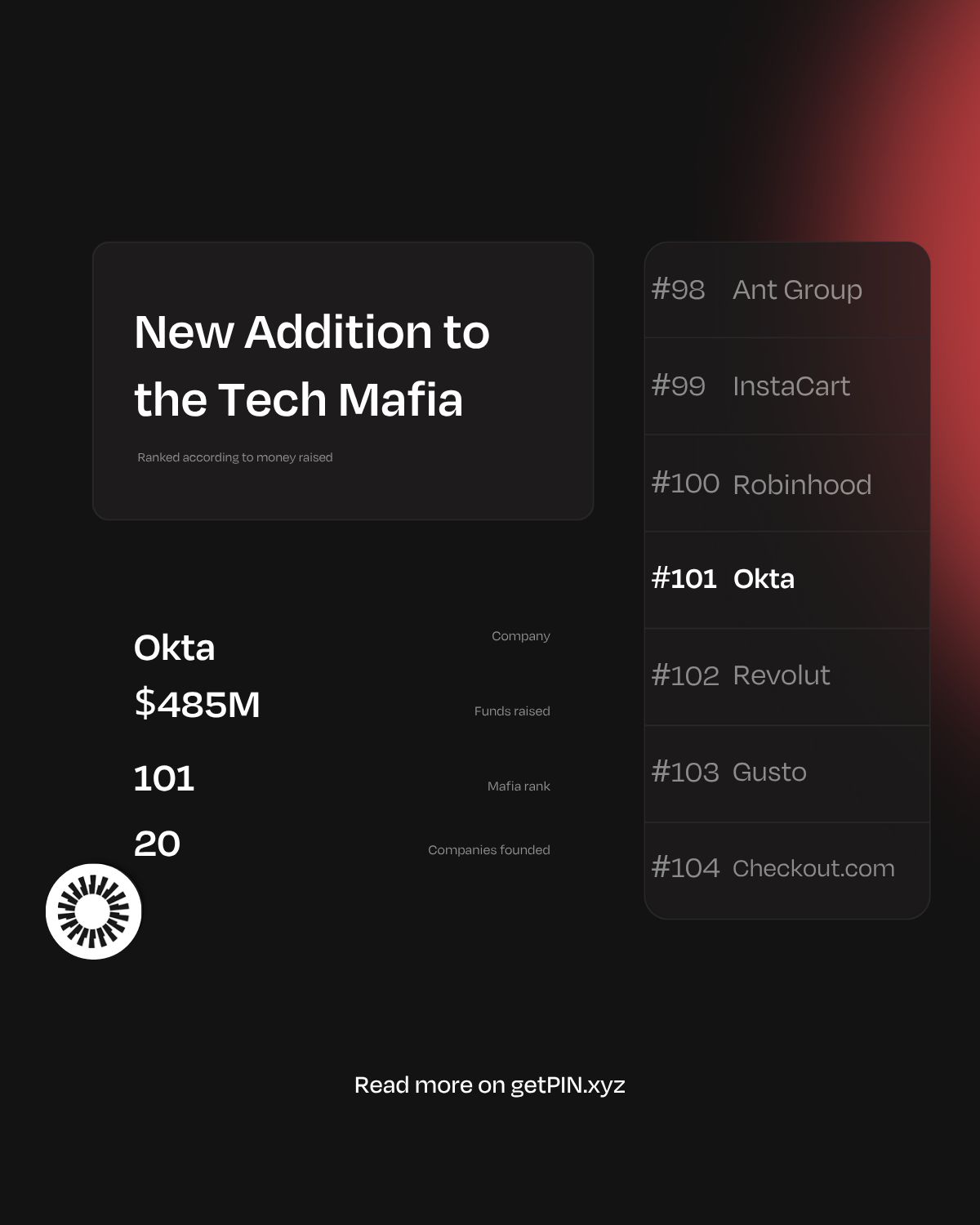

🤑 Total money raised by the Okta Mafia: $485 million

Weekly Tech Mafia Leaderboard

The Okta alumni has built some amazing companies. This tech mafia group takes the 101st spot on our leaderboard, with 20 companies founded and $485 million raised.

PS: Are you an Okta alum interested in getting your community together to invest in the community (and earn carry/other benefits along the way)? Or are you a member of another community that you think would make for an amazing startup investment community?

Learn more about us and sign up for the waitlist here.

📌 PIN tweet of the week

The new Y Combinator cohort is out, and as always, it’s a great snapshot of where innovation is heading.

What do we know so far about the startups?

▸ 30% are building for developers.

▸ Notable sectors include B2B productivity, healthcare, industrials, and fintech.

▸ 60%

— PIN (@getpinxyz)

1:50 PM • Sep 29, 2025

💼 Who’s hiring in VC?

Looking to get into VC? Below are this week’s curated VC job openings.

Amazon is looking for an Industrial Innovation Fund Principal.

Connecticut Innovations is looking for a Director.

Owl Ventures is looking for a VC Associate.

Rhapsody Venture Partners is looking for a VC Analyst.

📌 PinPoint - Get paid to refer your friends to great jobs

Want to earn thousands of dollars for referring candidates to top companies? Sign up to PinPoint.

📠 Fun fact of the week

The most expensive phone number sold went for $2.75 million.